How You Can Save

Hundreds

Of Thousands In Taxes Even If You Already Have A CPA?

Dentists, physicians, and small business owners are changing their lives forever by saving $100k+ in their taxes. LEGALLY!

Deadline: December 31st

Start Planning Today To Save In 2024!

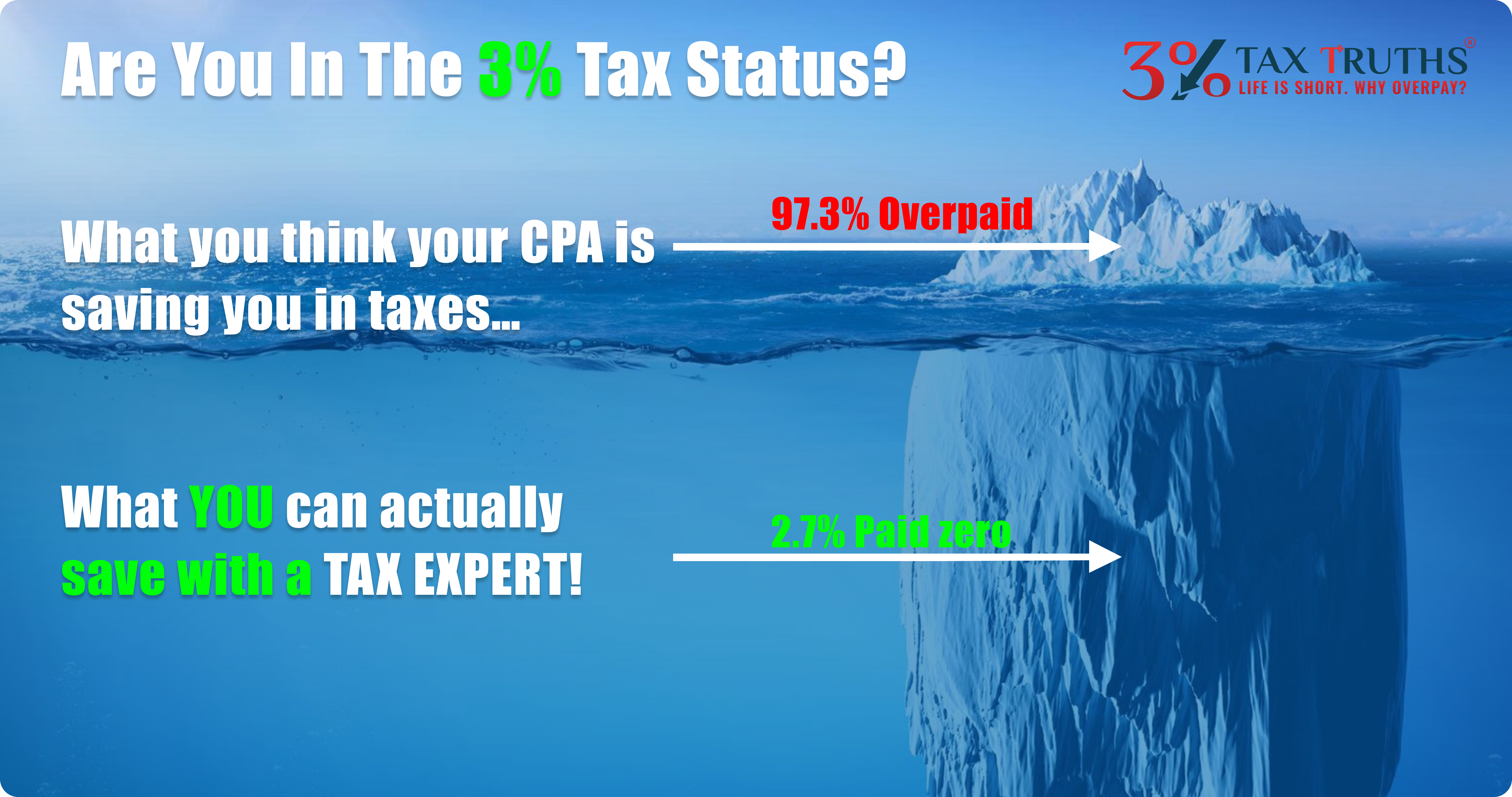

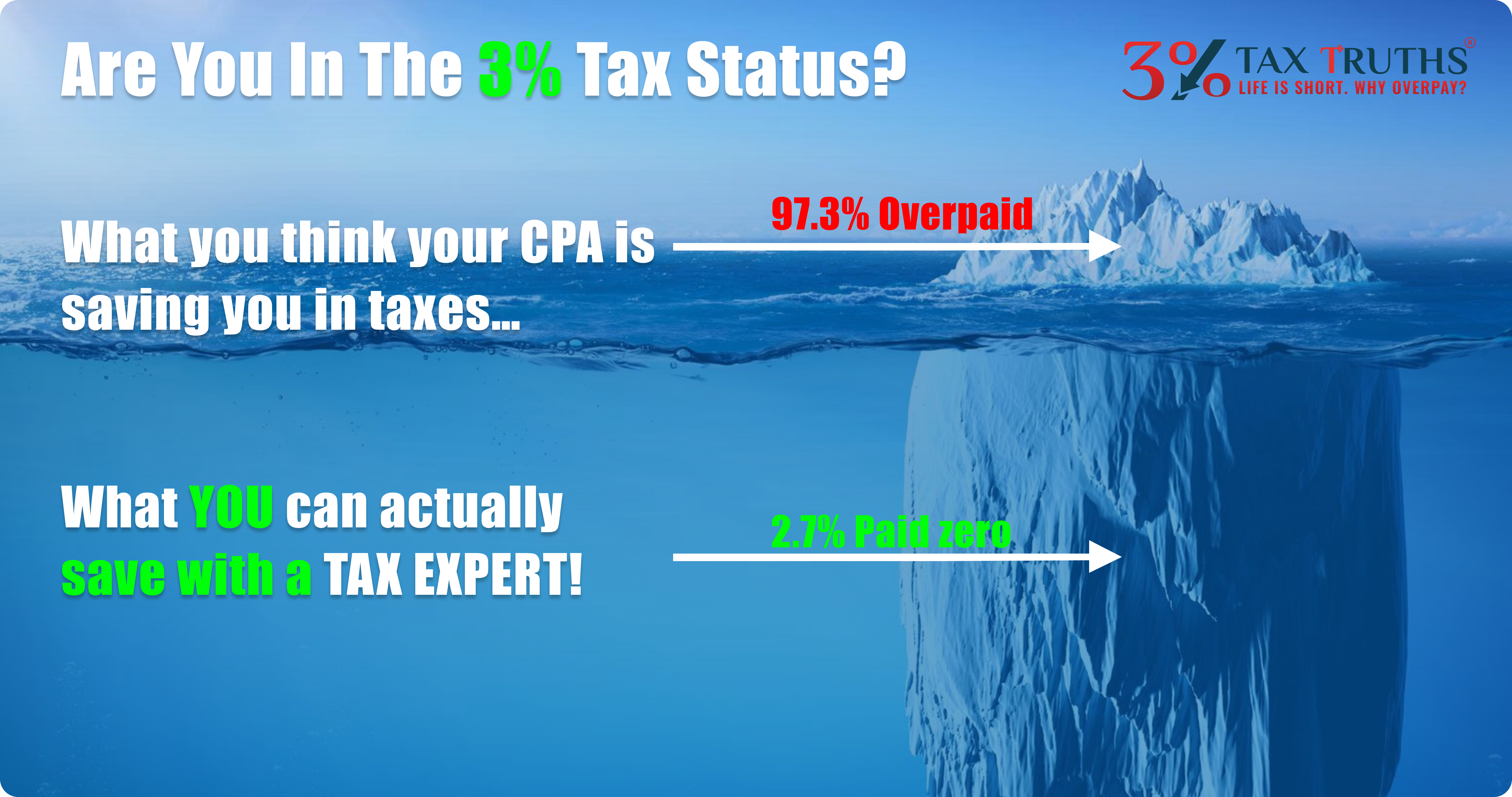

How Much are You Going to Pay in Taxes for 2023? Is your CPA Saving You Money or Costing You Money?

We BELIEVE that it is Your Right NOT TO PAY TAXES!

Act Now

One of the biggest problems in this country

Is that most Dentists, physicians and small business owners believe that their CPA, Accountant, Tax Preparer is saving them money on taxes.

But they aren’t. They’re just preparing the returns.

Tax Preparation =

Cost

Tax Advisory Services =

Investment with ROI

The truth is, Nobody wants to pay more in tax than they need to.

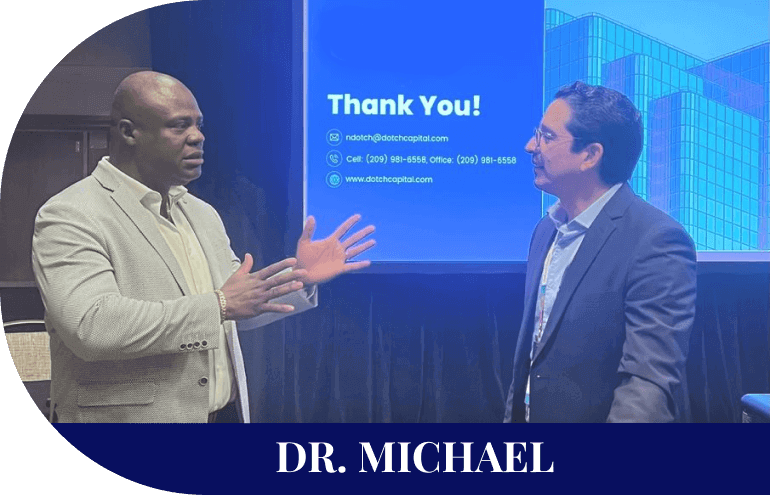

CLIENT RESULT!

Meet Dr. Michael, a Dentist 15 Years in practice with a hefty $263,465 tax bill for 2022. Completely frustrated with his CPA.

Decided to work with us; saved him.

FOR 2023

$158,079

FOR 2024

$158,079

FOR 2025

$176,521

*And each year going forward

What you lost last year...

2022

Payment to Accountant

2022

Estimated Overpayment

$158,079

2022

What you Paid.

its just that the accountant split it with the IRS

This is How We Helped Our Clients!

At 3% Tax Truths, we are EXPERT in helping dentists, physicians and small businesses owners LEGALLY save over $100,000 in taxes; YEARLY!

1

We provide a structured plan where businesses can efficiently manage and reimburse employee expenses(business-related expenditures)

?

2

We also offer advice on how to use your house as a short-term rental. You can maximize the value of your property in a tax-efficient manner.

?

3

Our approach includes strategies to deduct relevant expenses for those who use a portion of their home for business purposes.

?

4

We advise businesses on effectively incorporating travel expenses into their financial framework.

?

5

Our financial solutions cover a wide range of health-related expenses, allowing compensation for necessary out-of-pocket health costs.

?

Hi, I'm Norman Dotch, Tax Advisor, Registered Investment Advisor (RIA) and CEO of 3% Tax Truths

For over two decades as a tax strategist and Registered Investment Advisor (RIA), I have devoted my career to helping Dentists, physicians and small business owners with complex corporate & personal tax planning by designing The FRAMEWORKS by which my clients are able not just to MASS but to MAINTAIN MASSIVE FORTUNES by taken the FRAMEWORK and APPLYING the FRAMEWORK consistently!

Norman Dotch, Tax Advisor

CEO, Tax Advisor & Registered Investment Advisor (RIA).

I hold my Series 7 & 66 securities licenses, a testament to my commitment to professional growth through rigorous education and training. My journey has been marked by prestigious accolades like membership of the Chairman’s Council and the Million Dollar Round Table (MDRT).

As a native Spanish speaker from Panama, I enjoy exploring the world with my family. I’m recognized as a leading tax planning expert and often invited as a keynote speaker at significant events like the LA DENTAL MEETING and LATINO TAX PRO conventions.

If you are reading this, it is because you are interested in learning how I have helped other successful Dentists, physicians and small business owners, such as you, save over $100K in taxes each year.

ACT NOW!

Let 3% Tax Truths help you live the same experience!

Norman Dotch, Tax Advisor

CEO, Tax Advisor & Registered Investment Advisor (RIA).

There is a reason why some American Families are one of the wealthiest in the entire world.

The FRAMEWORKS that allow these families to not only MASS but also MAINTAIN MASSIVE FORTUNES is because they took the FRAMEWORK and APPLIED it consistently!

And so, what you need to understand is that if you could save a portion of your INCOME from that taxation, year, after year, year after year, that alone creates MASSIVE OPPORTUNITIES for you and your family because taxes are AN EROSION OF WEALTH!

For over two decades, Norman Dotch, has helped Dentists, physicians and small business owners save millions in taxes by maximizing their business reductions.

To Discover your Tax Reduction Program

As a Dentists, physicians or small business owner, we know you're juggling a busy schedule and don’t have the time to deal with the IRS’ complex tax laws. As we we are in 2024, your CPA is likely asking you to send your year-end numbers and NOT talking to you about ways to maximize your savings by increasing your deductions before the year ends. LEGALLY!

Warning: 286,000+ Dental practice in the US aren’t properly structured to take advantage of existing tax laws So, they are making billions in donations to the IRS each year…

Why would Dentists, physicians and small business owners make these donations? WHY ARE THEY OVER PAYING IN TAXES?

Did you know you could save over $100,000 in taxes yearly? But if you’re not taking action, you’re choosing to let that money slip away. The clock is ticking, and December 31st is just around the corner. Only your wise decision can impact your financial health this time.

At 3% Tax Truths, we’re experts in uncovering the tax savings dental professionals often miss. It’s not just about a one-time tax cut; we offer a strategic approach that ensures long-term financial benefits. By working with us, you’ll minimize your tax bill for this year and set the stage for continued financial growth.

Remember, every day you delay is a potential loss in savings. With the end of the year fast approaching, now is the time to act. Take advantage of this opportunity to enhance your financial well-being. Reach out to 3% Tax Truths today, and let’s secure your savings before the deadline. The choice is yours: act now or miss out on over $100,000 in tax savings. What will your decision be?

If you haven’t made up your mind yet!

We remind you!

It is your Chance! ACT NOW!

10X your savings with 3% Tax Truths before the end of 2024!

Clock is ticking

You might wonder why I’m passionate about helping you save more on taxes. The answer lies in my core belief that effective tax management is a key component of financial success and freedom. Here’s why I’m committed to ensuring you keep more of your hard-earned money:

- Empowering Financial Growth

- Personalized Financial Strategies

- Long-Term Financial Security

- Reducing Financial Stress

- Wealthy in TEN Method

- Building Strong Client Relationships

Disclaimer: The information provided in this guide and through any consulting sessions is intended for general guidance and informational purposes only. It should not be considered as professional financial or legal advice. Each individual’s financial situation is unique, and you should consult with a qualified professional before making any financial decisions. 3% Tax Truths does not assume any liability for actions taken based on the information provided in this guide or during consultation sessions

© 2024 3% Tax Truths. All Rights Reserved.